Sanitary ware Sector in India

Urbanisation and access to education, coupled with the western influences have led to increased awareness about sanitation and hygiene in India. Many Government initiatives have been launched to spread awareness about sanitation among the lower socio economic sections of the society. While these initiatives have been a ‘shot-in-the-arm’ for sanitary products catering to the mass market, the premium segment is also witnessing growth driven by the entry of multinational sanitary ware companies launching designer products and signature collections of their exclusive product range.

The premium range of the products is now considered as lifestyle products and consumers attach significant importance to their choice of brand and model. Leading companies as well as their multinational counterparts are focussed on brand building through advertisements, to face intense competition in the middle and premium segments of the market. Strengthening the distribution network is another focus area to reach out to expanding market.

The Indian sanitary market is fairly organised and the organised segment caters to the middle and premium markets with high end quality products. The unorganised segments is largely volume driven and caters to the lower income strata. Valued at INR 25 billion in 2012-13, the Indian sanitary market has grown at the rate of 10-15% annually in the last five years. Low cost of production and the availability of labour have been an attraction for foreign sanitary ware players to operate in India.

The premium and mid segment sanitary ware products account for around 40% of the total market and are expected to gain share in the future. The residential real estate sector is the leading consumer segment and water closets account for a major share among the sanitary ware products segment. Cisterns, wash basins are other noted products, bidets and urinals have a relatively small domestic demand.

Hindustan Sanitary Ware India Ltd. (HSIL) is the market leader in the Indian sanitary ware market, followed by Roca India and Cera Sanitary Ware Ltd. Noted foreign brands available in India are Duravit, Benevalve, Queo and Kohler.

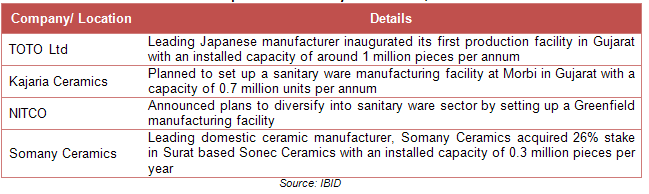

Apart from expansion plans announced by leading players, the sanitary ware market is also witnessing the entry of new players, both domestic and international.

Nice information about the sanitary ware industry. The sanitary ware industry is growing up day by day because they are exploring the customer needs. They are also increasing the product range and making stylish products for the customer.

Dear sir/madam,

We require the report for understanding the industry.

Please revert back.

With warm regards

Manohar GM